Expanding the set of feasible allocations

What economics can tell us about mobilizing group action

Originally published May 24, 2019 on Medium

Two neighbours may agree to drain a meadow, which they possess in common; because ’tis easy for them to know each others mind; and each must perceive, that the immediate consequence of his failing in his part, is the abandoning the whole project. But ’tis very difficult, and indeed impossible, that a thousand persons shou’d agree in any such action; it being difficult for them to concert so complicated a design, and still more difficult for them to execute it; while each seeks a pretext to free himself of the trouble and expence, and wou’d lay the whole burden on others.

David Hume, A Treatise of Human Nature (1739)

Economists have long thought about why certain goods and services are undersupplied. This applies especially to ecosystems, to which the passage above from David Hume alludes (though today we might actually be talking about two neighbors returning a drained meadow to its previous state).

Hume’s response to the question was government intervention, or “Political society.” Here I would like to discuss what I believe is one of the major issues in social-ecological systems today: how to provide public or common-pool resources in an era where we can no longer be sure existing institutions will provide them.

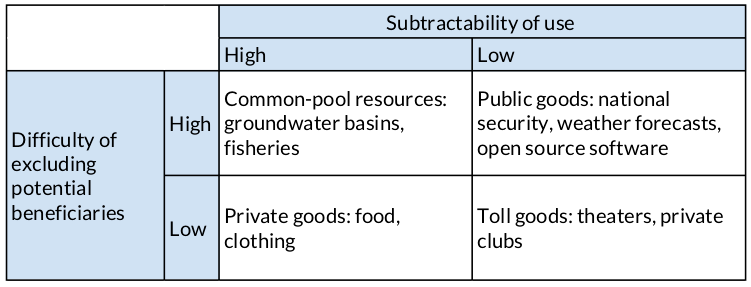

While there is considerable literature on the subject of collective action, here is a quick illustration of how many economists typically think about this topic:

If I grow apples for sale, it is relatively easy for me to capture the value created that activity. I simply keep possession of it until you pay me, at which point I give it to you, where you now enjoy the right to exclude others from consuming it. Moreover, because apples can only be eaten once, they are also considered to be rival, or subtractable in nature. These two characteristics represent the classic definition of a private good.

In contrast, consider open source software. Open source software is non-excludable by design: the entire point is to make the source code available. Moreover, software code does not get depleted in the sense an apple is consumed, so neither is it subtractable. In contrast to an apple, open source software would be considered a public good.

There are other configurations of goods, as illustrated in the figure below:

The question is how to solve so-called collective action problems that arise when there are no effective ways to sanction parties that over-extract common pool resources, or when there is no feasible way to prevent everyone from enjoying the consumption or use of public goods.

Reconfiguring the resource matrix

What tools can we mobilize to help solve collective action problems without the need for the intervention of a state or privatizing a commons? (Privatizing a commons also invokes state power, but that’s a topic for another article.)

Let’s work through this by reconfiguring the elements of our matrix of goods. In other words, can we make a currently un-excludable resource excludable, or can we make a currently subtractable resource un-subtractable?

This is already being done with excludability, in the form of fishery quotas, or when developers of open source software earn revenues from providing support, or hosting applications built with the software. In the case of fishery quotas, the remedy is to create a tool to exclude the open entry of participants. In the case of software, the excludable dimension is the time required to make the software work for unique clients.

Correcting the subtractability problem is a little more indirect — consuming a resource is usually a one-way street. So a solution will require either reducing the extraction of the resource below the level of natural replenishment, or compelling the users to “restock” the resource. These approaches are reflected in the institutions created to manage groundwater in parts of California in the 20th century (and more recently, statewide). In essence, groundwater users created institutions through legal agreements and the state’s special district laws to set allowable extraction rates for each participant, and provide for the common replenishment of the subtractable resource.

This idea was given a fresh treatment in recent years in the form of proposed ecosystem service districts, which has not achieved much traction but could point to a way forward in this area.

Institutions and instruments

What if, in addition to these approaches, we created a new class of assets with their value based on self-restraint or forbearance with respect to exploiting living resources? Then the dominant strategy for decision makers would be to consider the global benefits of the resource, rather than their own narrow interests. It’s an attractive concept, but comes with its own challenges.

The intellectual foundations for so-called environmental markets, from carbon to water to biodiversity, date back decades. Yet aside for a few successes that continue to fade into the mists of time, they have found only limited use.

In 2018, The Willamette Partnership and Ecosystem Marketplace released a report on the potential of (and barriers to) water quality trading markets in the United States. It focuses squarely on the demand side: why are buyers not engaging with these markets?

Having worked to develop markets for agricultural products, I totally get it. Understanding the perspectives and needs of buyers is critical. If I was a grower and was choosing between putting in a block of Red Delicious apples or the hot new cultivar instead, I might choose the latter. But let’s not forget there are other factors to this decision when we are talking about ecosystem services, not the most well-known “products” out there.

From the perspective of an apple grower, the decision to go with a new variety is fairly well understood: they know how to grow apples, and that know-how should translate easily into other varieties. Meanwhile, the apple buyer at the regional grocery chain can sample a new variety and figure how many boxes they should be able to move. This is how a well-established market works, with widely known business practices and institutional relationships that extend over years, if not decades.

So how does this apply to environmental markets and regenerative project finance? Over the past few years, I have come to believe that the supply of ecological functions (inasmuch as human institutions govern them) is the limiting factor in market-based approaches to ecological regeneration.

When a paper claims it is possible to store 288 billion metric tons of carbon in agricultural soils, it is important to also ask “at what cost?” because land stewards face more than just the direct costs of activities, which is often the unstated assumption of soil carbon sequestration proponents. Sure, The USDA Natural Resource Conservation Service will pay $37.48 per acre for a grower to plant a cover crop in Oregon (subject to the conditions of the Environmental Quality Incentives Program — EQIP), which approximates some of the direct costs, but omitted from nearly all the analyses I’ve seen are some of those old chestnuts from economic thought: transaction costs and opportunity costs.

To be fair, some ag soil carbon proponents, such as Project Drawdown, have written they don’t think costs are that substantial for agricultural soil carbon. And maybe they’re right. On the other hand, I can point to three distinct lines of reasoning and evidence to the contrary.

- First, not all soils and climates have similar potential to store carbon. For all the places where it’s totally profitable from year one, there are places where every kilogram of carbon comes with a fight, and it will never make sense to manage for soil carbon storage, even with substantial subsidies.

- Second, not all land managers have the same knowledge and incentive structures. The expert wheat grower may not be as up to speed on managing soil carbon, or may be nearing retirement and can’t be bothered with learning a whole new suite of practices. Meanwhile, the real estate investor that buys the land when the farmer retires doesn’t really care either. This can be corrected, but it comes with costs that are not captured in NRCS’s budget.

- Finally, all we need to do is look at the present adoption of carbon-sequestering practices in agriculture: how is that going?

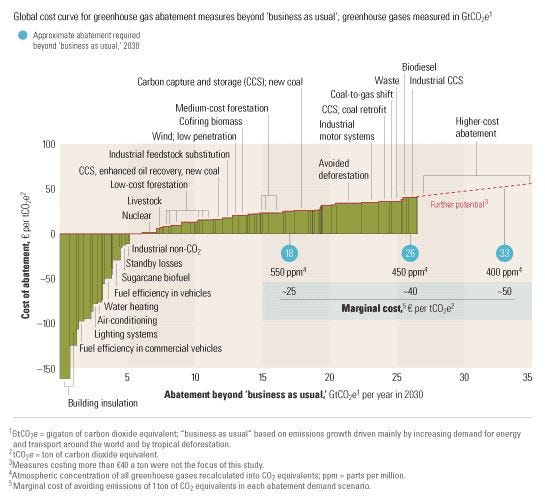

For perspective, consider the well-known cost curve for carbon emissions abatement published by McKinsey over a decade ago:

Twelve years later, we still have a ways to go for even the lowest-hanging fruit. But why, if these are such easy wins? Applying this to market-based approaches to earth repair, I think one of the big reasons is that we are making the wrong assumptions about the perspectives of farmers, growers, and ranchers.

Consider a survey published in 2017 by the USDA Economic Research Service, which looked at economic experiments for policy analysis in agriculture. One of the studies reported the following finding:

Farmers’ discount rates — a measure of the amount of compensation farmers require when they agree to receive payments at a later time instead of today — play a large role in their decisions regarding crop rotations, input choices, investment in machinery or structures, adoption of new technologies, and provision of environmental services, including participation in conservation programs.

Note: “Farmers’ discount rates…play a large role in their…provision of environmental services.”

This study found that farmers participating in a conservation payments program had a 34 percent discount rate for a nine-month delay in payment for a conservation program. For economists who typically work on government-funded studies that assume discount rates of five percent or less per year, this can be somewhat shocking to see. But of course it makes sense for a commercial operation that has many potential investments to evaluate, on top of the risk that comes with production agriculture, not to mention an innate skepticism of ideas like environmental markets. Forget the studies that say a carbon sequestration project “breaks even” at $5 per ton, $10 per ton, or even more. For the people doing all the on-the-ground work, it’s barely enough to achieve a payback after one year, let alone the five or ten years we’re talking about with market-based tools like carbon or nutrient credits.

An additional problem is that the entities responsible for operating some of these markets are often charged with enforcing the underlying laws that made the markets in the first place. If I’m a dairy operator considering participation in a water quality trading program, then I am tacitly saying I contribute to water pollution. Why would I put my trust in the California State Water Resources Control Board to earn a few thousand dollars per year if it means I also expose myself to legal liability, even if it is the right thing to do?

Is it really a market if it is mandated by the government?

I have grappled with that question for more than a decade now.

You may be familiar with the phrase, “everything which is not forbidden is allowed,” along with its converse, “everything which is not allowed is forbidden.” I would suggest that in today’s market-based environmental approaches, participants are largely subject to the second principle. This makes it difficult to reconcile participatory or co-creation ethics, or Elinor Ostrom’s design principles for governance, with the current state of environmental markets, even (maybe especially) voluntary ones. Everything is verboten until proven otherwise; if we want to act we must seek permission from an authority. Shouldn’t it be the other way around?

This problem is clear in the case of compliance markets. Voluntary markets would seem to be ideal, except… they are barely making a dent in the problems they are meant to address: for example, net carbon sequestration projects (as opposed to just emissions reductions) represented only about six percent of the carbon market volume in 2016. Even proponents are writing about how the primary growth opportunities for carbon markets rely on compliance market authorities recognizing voluntary offsets. More permission seeking is likely to continue.

I say this because I want voluntary approaches to work, but as I wrote above, I believe the regenerative economy is supply — not demand — limited. The conventional wisdom that says “demand creates supply” works in ordinary markets, but ecosystems aren’t ordinary; maybe it’s time we stopped forcing them into that mold.

Thoughts on how to get there

I can’t just lay out a list of problems without addressing some potential responses, so I will summarize them here:

- Form institutions with the appropriate powers to address issues of common concern. In the United States, there is ample precedent for the formation of community-driven special districts that exist to serve specific, localized needs. There is no reason this concept cannot be applied to ecosystem governance. For example, in 2015, the Oregon legislature authorized the formation of sand control districts to provide coastal communities with tools to fund activities related to sand management, such as dune vegetation projects. These institutional approaches extend beyond geographic areas of interest, and can include whole industries, such as those represented in state crop commissions and agricultural marketing agreements. How about a carbon storage or biodiversity district?

- Radically reduce the risks posed to land stewards for switching to regenerative land management practices. Maybe, at some point, purely market-based premiums might provide sufficient incentives, but we’ve been waiting for that ship to sail for 30 years. I am thinking of breakthroughs in ecological technology (in the broadest sense), coupled with the governance innovations described above, to really make things happen on the ground. I am a little leery of making a comparison to the Industrial Revolution, but we really need changes of that magnitude in our abilities to provision and support ecosystem health.

- A final recommendation, which I didn’t discuss in this article, but which supports the above two items, is to dramatically improve the public sharing of information about ecosystems. This includes ecological, as well as economic and demographic information. We already have seen promising work on the former, with efforts such as the Ocean Health Index, but we really need more on the latter two as well, and not just limited to reports issued once every few years — we need continuous data and analysis on a much finer scale than is currently practiced. Any project, public or private, that involves marshaling resources for ecological health needs to devote sufficient resources for data sharing. This could also include support for open access scientific and industry publishers, helping bring back another important commons that has been increasingly enclosed behind expensive paywalls.

Whatever we come up with needs to be better than the status quo in economic and social terms, because we cannot count on consistent support from lawmakers. While we’re at it, we must also leverage broadly accepted legal foundations that can survive scrutiny by the most committed opponents, who are not going away any time soon. This leads us to the role of legal institutions in ecology, a topic for another day...